[client-facing marketing article; use as a follow-on to the free Growth-Drive Lead Generator]

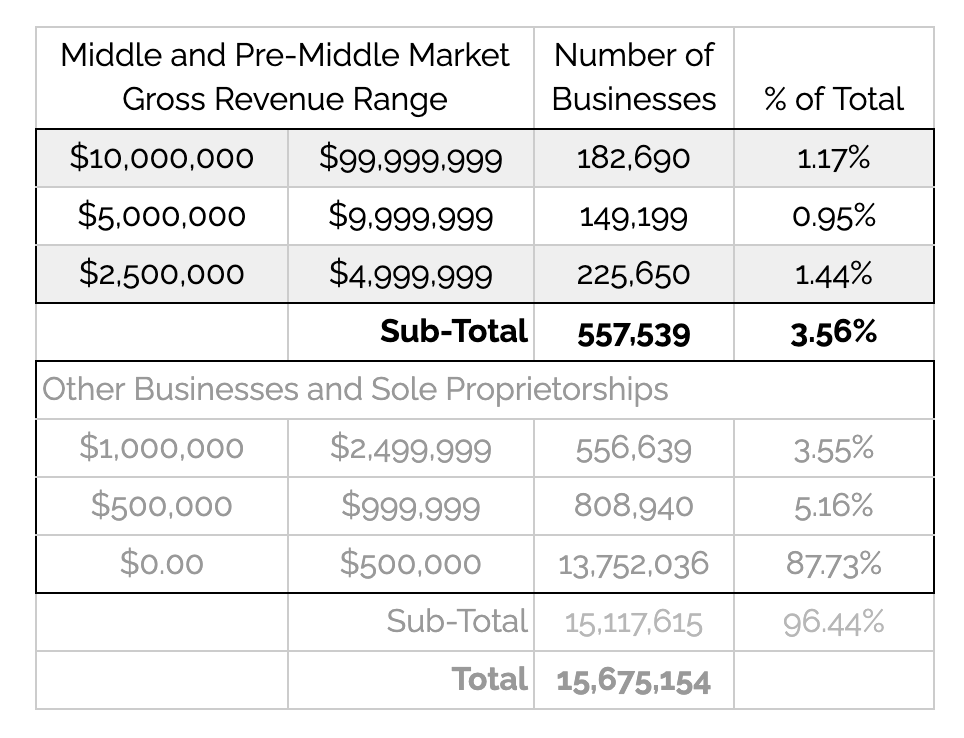

In Part 1 of this two-part article you learned about Strategic Capacity and re-designing a business so that it adopts the principles of best-in-class businesses to maximize profits, growth and transferable value. Now let’s turn to the impact that your size and Strategic Capacity have on your options for monetizing value. Here are some stats from “The Growth-Driving Advisor: Proven Strategies for Leading Businesses from Stuck to Best-in-Class”.

“There are 32.6MM private businesses in the United States, of which 7.8 million have payroll. Of these 560,000 have revenues from $2.5MM-$100MM. This is the Middle Market, in which businesses generate over $10 Trillion in annual revenues, almost 50% of US GDP. If ranked as a world economy the Middle Market would be #3, larger than the GDP of Japan and Germany combined. Private businesses provide 44% of US jobs, and 63% of new jobs.”

"The Growth-Driving Advisor: Proven Strategies for Leading Businesses from Stuck to Best-in-Class”. Sandmann, George. Forbes Books Charleston SC 2023.

‘Strategic Capacity’ refers to an organization's ability to achieve its goals and objectives in a sustainable and predictable manner. Strategic Capacity is driven by your performance in the Three Dimensions of Business Growth™: creating predictable profits, growth and transferable value. It encompasses the resources, processes, and systems that enable a business to adapt to changing market conditions and maintain a competitive advantage. Here's a breakdown of key aspects:

- Capability: The skills and resources to get things done

- Alignment: Ensuring all activities support the business's overall strategic intent

- Operational Excellence: Optimizing processes and systems for maximum efficiency

Strategic Capacity includes two elements:

- Growth Capacity: your demonstrable ability to sustainably grow profits and cash going into the future

- Value Capacity: M&A Preparedness, meaning your demonstrable ability to create high confidence (even excitement) in a buyer that your people, cash and processes (1) have a strong history of delivering growth and (2) can be predicted to deliver growing profits and value going into the future.

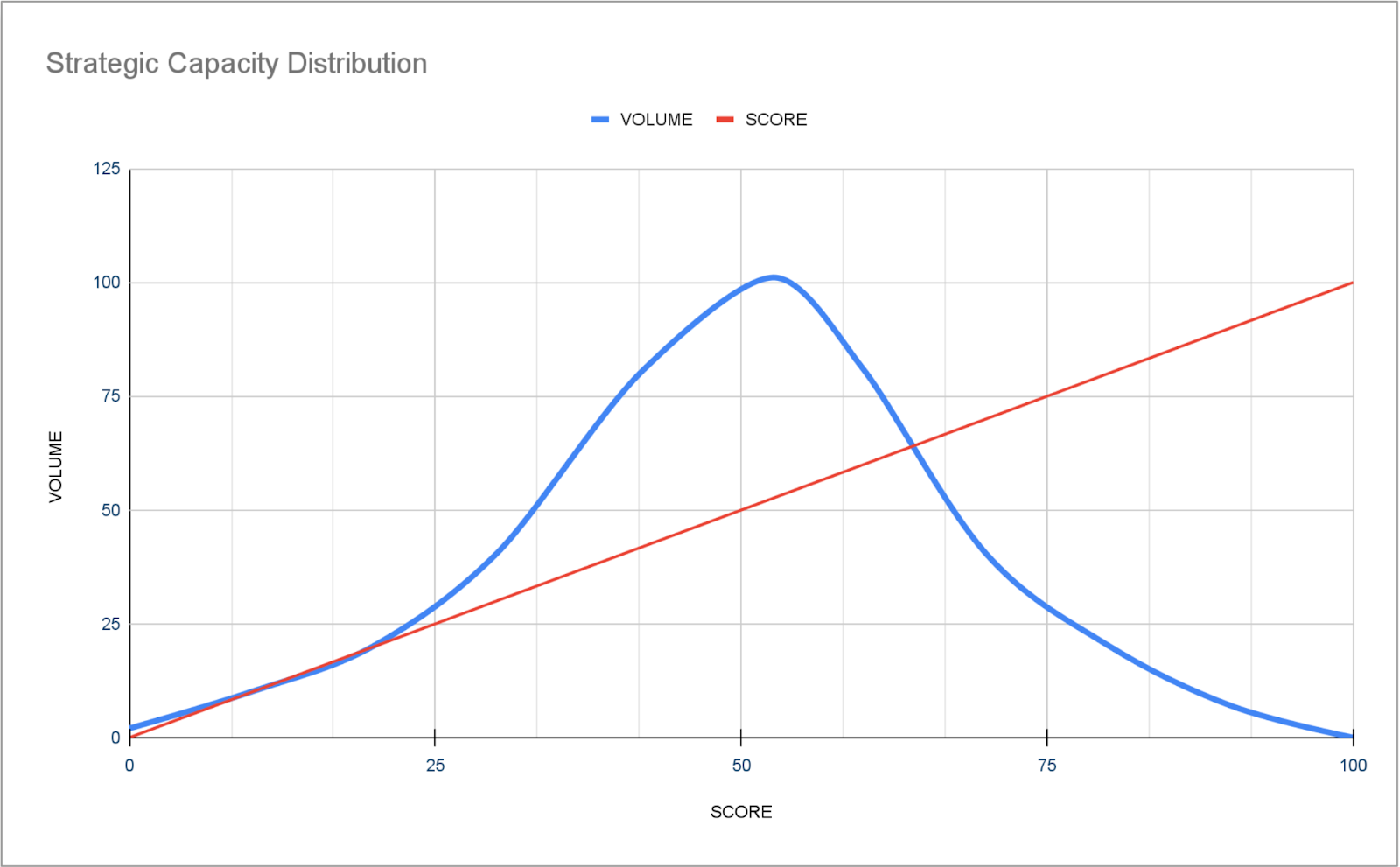

When considering your Strategic Capacity score:

- 57 of 100 is the middle of the bell curve; average is 54.13

- Scoring is logarithmic: moving from 57 to 70 is an exponential increase; moving from 70 to 85 is again. Only a small fraction of businesses score >85; there are no 100s.

- With diligent focus a business can expect to increase its Strategic Capacity by approx. 10% per year

- What this means for you: if you're like most businesses you have the raw materials for increasing capacity in Dimension 1 'Predictable Profits & Cash Flow" and Dimension 2 "Predictable Sustainable Growth" - and have never experienced the kick in the teeth that can come from showing up with low capacity in Dimension 3 'Predictable Transferable Value'.

Let’s look at several charts explaining how size and strategic capacity impacts transferable value -aka the price you may get at the deal table. We’ll then explore the various tools for monetizing value.

Chart 1: The Market

NOTE: According to Crunchbase and the US Census Bureau there are only approximately 10,000 privately held businesses with revenues over $100MM.

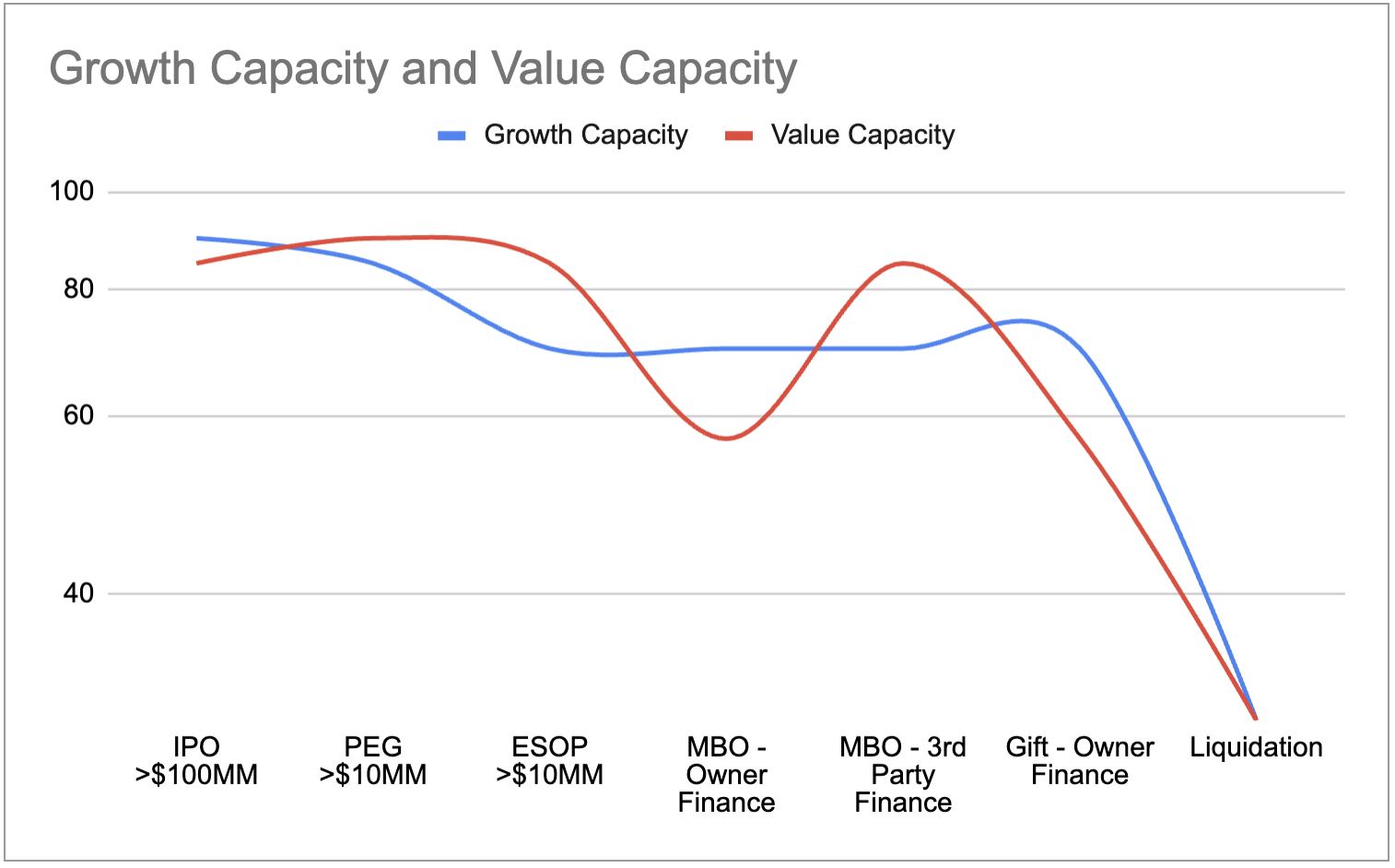

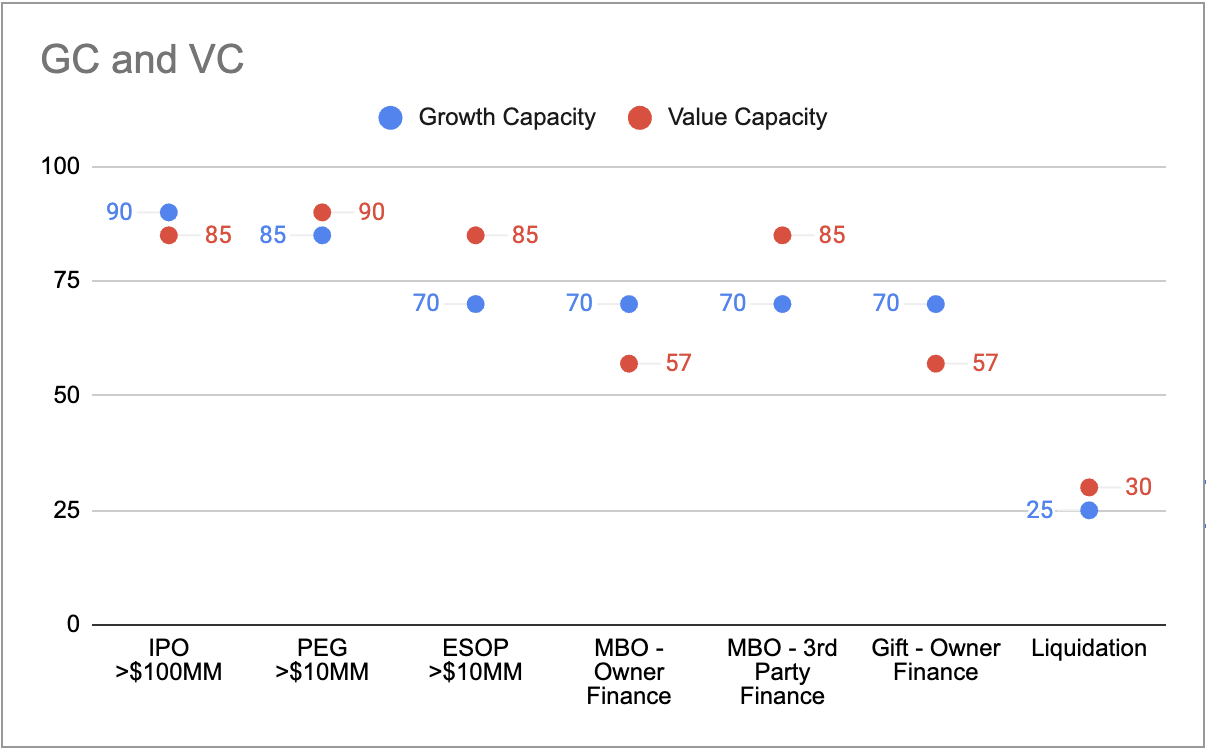

Chart 2: Required Size and Quality (Strategic Capacity) by Transaction Type

Chart 3: Target Growth Capacity and Value Capacity Scores, by Transaction Type

Chart 4: Distribution of Businesses Across the Strategic Capacity Scoring Range

Key Takeaways:

- There are very few businesses in the >$10MM AGR market and only 10K bigger than $100MM

- Fewer than 5% of businesses have the strategic capacity to successfully complete an M&A or similar transaction as they are currently run

- As you contemplate monetizing business value you must consider your objectives and strategic capacity. For example, in an MBO where you hold the paper (owner financing) you will care deeply about growth capacity because this goes directly to the business having the predictable cash flow needed to pay off your note. You may be less demanding than a 3rd party when it comes to value capacity - you know the business well, and are innately confident in the financial reporting processes, risk profile etc.

- A generational succession typically includes seller financing; achieving and maintaining high Strategic Capacity will help the successor generation inherit a business that is well run while affording you peace of mind that retirement will be adequately funded

- Size matters: because of their maturity businesses larger than $25MM often generate a price with an ‘extra’ 0.5-1.0 multiple of earnings: this can increase to 2X for >$50MM AGR. But size does not excuse a lack of strategic capacity - the buyer must still have high confidence in predictable future growth.

Overview of Transaction Types

Converting your Life’s Work into Cash: Equity Value Monetization Tools

Overview: IPO - “the Unicorn of Deals”

The landscape: Very few businesses successfully complete an IPO - it is the unicorn of deals. They exist, we all talk about them, but essentially no one completes one (and yet the press fawns all over them, weird). There were significantly fewer US IPOs in 2023 compared to the record-breaking year of 2021. Here's a general breakdown:

- 2023: Approximately 150-180 IPOs; the exact number varies slightly depending on the source and the size of IPOs included in the count

- 2022: A very slow year, with around 90 IPOs

- 2021: Over 1,000 IPOs

Why the Decline? The substantial drop is mainly due to:

- Economic Uncertainty: Inflation, rising interest rates, and geopolitical tensions created a volatile market environment, making many companies hesitant to go public

- Poor Post-IPO Performance: Many companies that went public in 2021 performed poorly, discouraging potential IPO candidates and dampening investor interest

How Strategic Capacity impacts these deals: bottom line, the IPO is only available to businesses bigger than $100MM and with Strategic Capacity >85 - a subset of 1%.

Overview: Private Equity

The landscape: According to S&P Global Market Intelligence, 2023 saw a significant drop in private equity and venture capital deal value and volume. The number of transactions dropped from 4,006 in 2022 to 2,761 (-34.7% year over year). Several factors including inflation, rising interest rates and geopolitical unrest contributed to the decline. Note that this decline in volume was accompanied by a quest for quality, with capital sources competing for high strategic capacity businesses, buoying prices. The result is fewer deals, but at historically consistent multiples.

To prepare, here’s what you should think through:

- Valuation: Get an understanding the valuation expectations, what it takes to attract multiple bidders, and factors impacting the sale price

- Due Diligence Preparedness: Having financials and documentation well-organized and able to satisfy buyer scrutiny

- Stakeholder Alignment: Ensuring alignment of management, board, and investors on the sale process and strategic intent (desired outcome)

- Demonstrating Growth: Emphasize growth track record, future potential, and the market outlook supporting that growth.

- Profitability Focus: Don't neglect profitability, as strong earnings solidify the investment case for buyers.

- Comparable Company Analysis: Understand how your PEG ratio compares to industry peers and be prepared to justify any premium.

How Strategic Capacity impacts these deals. If you;r goal is to maximize transferable value (price) then size and quality are the name of the game.

A word of caution: unsolicited offers; valuations. If you are contemplating a sale of any kind please do not do what so many of your colleagues do and assume the quality of the value you saw in an unsolicited LOI or that ‘valuation’ you were given to support life insurance. They are wrong. Talk to a pro, get educated about price. Did you know the price can be different depending on which monetization tool you use? Get educated.

Overview: MBO

The landscape: The Management Buy Out (MBO) is popular for several reasons including having a ready buyer coupled with relative ease of negotiation and due diligence. Key considerations for a business contemplating a Management Buyout (MBO):

Management Team Factors

- Capability and Ambition: The management team must possess the skills, experience, and drive to successfully lead the company as owners. A clear vision for the company's future is essential.

- Commitment: An MBO requires unwavering dedication from the management team, as they'll assume significantly more risk and responsibility.

- Team Dynamics: Team members need strong trust, compatibility, and clearly defined roles for a smooth transition and effective collaboration in the new ownership structure.

Financial Considerations

- Funding: Securing adequate financing is crucial and often the biggest challenge. Funding sources may include debt financing, seller financing, private equity investment, or a combination.

- Valuation: Agreeing on a fair valuation of the business is essential. Independent valuation experts can provide an impartial assessment.

- Financial Projections: Realistic projections demonstrating the company's ability to service debt, generate profits, and create value for the new owners.

Seller Considerations

- Exit Strategy: An MBO must align with the seller's exit goals, both in terms of financial expectations and timing.

- Degree of Involvement: Some sellers may want a clean break, while others might prefer a phased exit or an ongoing advisory role.

- Confidence in Management: The seller must have trust in the management team's ability to continue the company's success post-buyout.

Operational and Market Dynamics

- Growth Potential: Evaluate the business's potential for growth and profitability under the new ownership structure.

- Market Position: Assess the company's competitive advantages, market dynamics, and future outlook within its industry.

- Employee Impact: Consider how the MBO will affect employees and develop a communication plan to manage the transition.

Professional Support

- M&A Advisors: Partner with experienced M&A advisors to guide the process, negotiate terms, and structure the deal.

- Legal Counsel: Secure legal experts specializing in MBOs to ensure proper documentation, compliance, and protection of all parties' interests.

- Accountants: Consult with accountants for tax implications, financial modeling, and due diligence.

Important: An MBO is a complex transaction. Seeking expert advice early in the process is crucial to evaluate feasibility, navigate challenges, and ensure a successful outcome for all stakeholders.

Key trends in the Management Buyout (MBO) landscape:

- Increased Interest, but Cautious Activity: Economic uncertainty can make MBOs attractive as owners seek an exit strategy, but also make financing more challenging. This tension is leading to careful consideration of deals rather than a surge of activity.

- Emphasis on Value Creation: Focus is shifting to sustainable business models and post-buyout growth strategies, rather than pure cost-cutting measures of the past.

- Spotlight on Middle Market: While large-scale MBOs still occur, the middle market (companies with $50 million to $500 million in revenue) is seeing increased MBO interest due to potential for strong post-deal growth.

Funding for the transaction comes from commercial loans, PEGs, and seller notes.:

- Role of Private Equity: Many MBOs are facilitated by private equity (PE) firms providing financing and expertise. Understanding PE dynamics in MBO space is crucial.

- Use of Seller Financing: In challenging credit markets, more sellers are providing financing to make deals happen. This can accelerate the process but also warrants careful consideration of risks.

- SBA, Bank Loans: financing is available through the SBA, often in partnership with commercial banks.

- In all cases the ability of the existing management team to drive the business post-buyout is becoming a major factor in deal success.

Overview: ESOP

The landscape: There are tax and altruism advantages to the Employee Stock Ownership Plan (ESOP). Some investment bankers love ESOPS, some hate them. Key recommendations for a business considering an ESOP (Employee Stock Ownership Plan):

- Company Alignment: ESOPs work best with companies that have a positive culture, values aligned with shared ownership, and a desire to involve employees in the company's long-term success.

- Financial Health: The business should have stable cash flows, consistent profitability, and the ability to support the debt required to fund an ESOP.

- Exit Planning: For business owners looking to sell, consider if an ESOP aligns with your exit strategy goals and desired time frame.

Some ESOP trends to watch, along with resources for further exploration:

- Steady Growth: While not experiencing an explosive boom, ESOPs continue to be a popular employee ownership model, with a modest uptick in new plans formed each year.

- Increased Visibility: ESOPs are gaining more attention in the media and policy discussions as an effective tool for wealth sharing and retirement security for employees.

- Legislative Interest: There's ongoing interest from legislators to support ESOPs through favorable tax policies and potential new legislation that could further promote their use.

Specific Trends to Consider:

- Succession Planning Tool: ESOPs are increasingly recognized as a valuable exit strategy for business owners, especially for retiring baby boomers seeking a way to transition ownership while preserving company legacy.

- Retention and Recruitment Strategy: In a competitive labor market, companies are turning to ESOPs as a way to attract and retain top talent by offering ownership stakes.

- Focus on Sustainability: There's emphasis on using ESOPs to create long-term, sustainable businesses that benefit both employees and the communities they serve.

- Increased Use by Smaller Companies: While traditionally popular with large corporations, ESOPs are now being implemented by smaller and mid-sized businesses seeking an alternative ownership model.

Overview: Family Succession through Gifting

There are several ways to transfer a business from one generation to another. Among the most popular is gifting. Like the other types of transactions described above, gifting requires a defined level of strategic capacity. notably, it requires high growth capacity. This is because the seller will want high confidence that the buyer can continue the Legacy of growth and caring for customers and stakeholders.

Key considerations Include ensuring adequate future cash flow to carry the company through lean times as well as through the learning curve as the Next Generation takes the reins. As with other transaction types it is important to get professional advice from a competent business advisor and from legal and Financial advisors. These professionals can help ensure that the transaction is completed in a tax-efficient environment.

We'd love to know what you think, please email blog@growth-drive.com. You can chat with George directly, george@growth-drive.com. Email us or join the Growth-Drive Community for free if you'd like a copy of this article.