The Three CFO Roles That Separate Lifestyle Businesses from 85+ Assets

Private capital markets do not buy history.They buy confidence. The 85+ Strategic Capacity Asset Class represents businesses that operate at...

4 min read

George Sandmann, Founder

:

Mar 14, 2024 5:44:14 PM

[client-facing marketing article; use as a follow-on to the free Growth-Drive Lead Generator]

How will the Private Capital Markets view your business?

In this two-part article, you will learn:

Part 1: Why Growth-Drive’s CLARITY Strategic Capacity Analysis™ Score is critically important market intel

Premise: Businesses are created as an asset, not a job. The fundamental role of the CEO therefore is to maximize shareholder value within the context of the business’ mission and vision. To have utility, shareholder value will eventually need to become liquid (cash). There are several paths to monetizing the illiquid value of a privately-held business. These include:

Each of these require different revenue levels and Strategic Capacity. Getting granular, when creating a strategic plan that includes the eventual monetization of business value you must consider Strategic Capacity’s two elements, Growth Capacity and Value Capacity.

Logically, the first step in preparing a plan is to analyze a business’ Strategic Capacity. Here is Strategic Capacity defined (from Growth-Drive Glossary of Terms):

Strategic Capacity describes a business’ ability to outperform its peers at delivering growing profits and maximized transferable value. The two contributors to Strategic Capacity are Growth Capacity and Value Capacity. Strategic Capacity should be considered in the same context as the discount rate in a Discounted Cash Flow (DCF) valuation: high Strategic Capacity creates a low discount rate.

How do you generate a report on Strategic Capacity? It’s easy and only takes an hour or so working with a business advisor with Growth-Drive’s CLARITY Strategic Capacity Analysis.

The scoring system inside CLARITY measures a subject business against best-in-class competitors. Best-in-class is defined as a business with the qualities prized by the private capital markets: it measures attributes sought after by the bankers, accountants and lawyers serving sophisticated investors and private equity firms.

And the market is unforgiving. Here’s an analogy: The sea doesn’t care if you drown… It doesn't care if you’re a great person, have a family, or that you have friends and colleagues who depend on you. When you try to sell your business, you are being dropped far out to sea. The sea only cares how well you can swim. The market is exactly like the sea: build a business with high strategic capacity and you won’t drown, you’ll deliver for your family and stakeholders.

Ask yourself: given the stakes, how confident are you in your ability to swim? Keep in mind, 95% of your colleagues who agree to jump into the market don’t make it to shore. Will this be you?

Do you want to know how many businesses can approach an M&A transaction as they are currently run? The accepted answer is one in 20 companies. That's 5%. This is because the overwhelming majority of businesses do not have the Strategic Capacity (quality) needed to create high confidence in a buyer that the business will generate revenue and profit going into the future.

This is logical, and here’s why. Let's use a manufacturing company as our example. The range of multiples available for manufacturing companies run from a little under three times EBITDA (think profit - same/same but different) to a little over six times EBITDA. The minority of companies that successfully go to market share this spread, with deals more heavily loaded to the low end than the upper end.

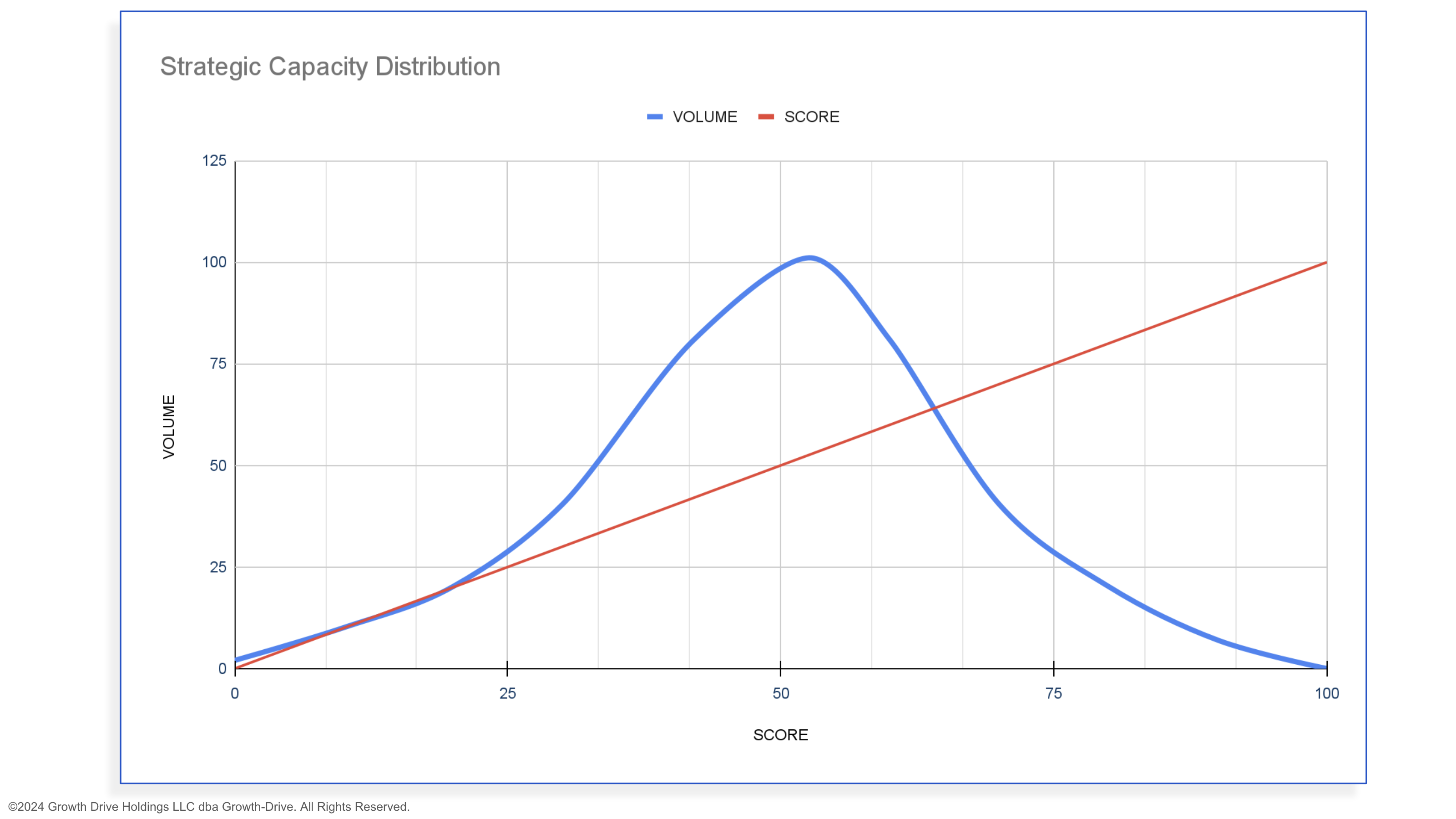

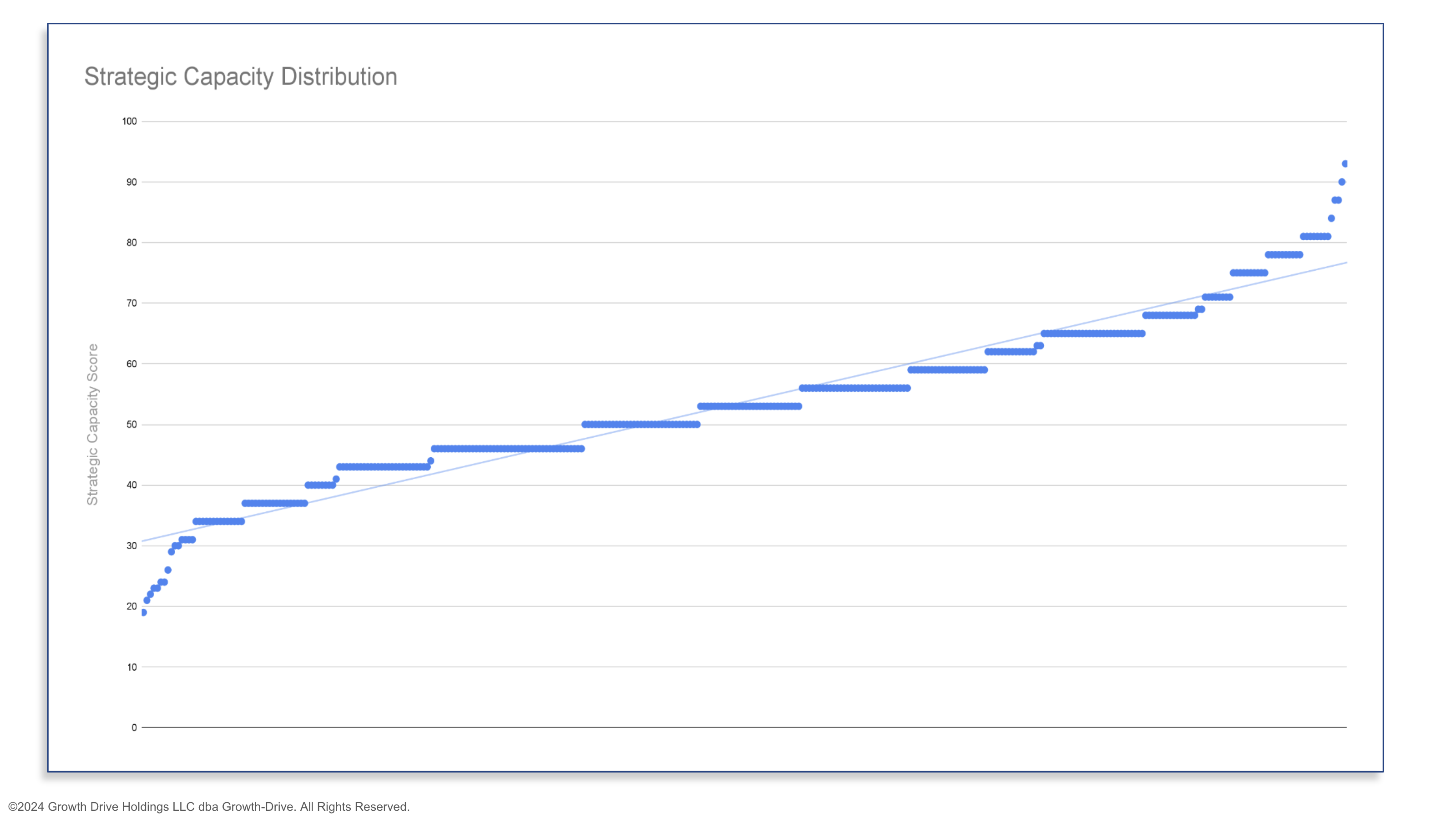

This explains why only a small percentage of the businesses analyzed using CLARITY will generate a score of 85 points or better. The average business has a score of 53.48 - we didn't make this decision, the private capital markets did.

So if the average company has a score of 53, what should be our first goal? We recommend getting the business to a score of 70. 70 creates a bunch of options - growing revenues, improved value, and better transferability. But getting from 53 to 70 is hard.

What may seem like an incremental increase is actually exponential. You see, CLARITY’s scoring system is similar to the Richter scale and decibel meter. Increases are not incremental, they are logarithmic. The average business may score 53, but significantly less than 20% of businesses can score a 70. As we've already seen, only 5% or so score >85. Please note that there is no such thing as 100 -there is no perfect business. Success creates a constantly evolving kaleidoscope of bottlenecks, which is why it is critical that you consult with a professional business advisor.

Here are two charts that explain:

Chart 1: Strategic Capacity Distribution by Volume and Score

Chart 2: Strategic Capacity Distribution by Score with Trendline

Now the fun stuff: PEGs grow businesses all the time, right? Yes they do, and they keep the money. And you can too - you can run a self-directed private equity play on your own business. But here’s the thing: PEGs hold businesses for an average of 5-7 years. Vast generalization for sure; bottom line: PEGs are pros and they take a long time to increase revenues and transferable value. Honestly, growing revenues is the easy part - it’s building and maintaining the Strategic Capacity required to sell the business upstream that’s hard.

Here’s how this influences your strategic planning: three years is a rational minimum for executing a growth plan, and 5-7 years is ideal.

Let’s recap your key takeaways:

Now that you’ve wrapped your head around these realities, you might consider speaking with a senior pro, analyzing your business, and executing a plan to successfully reach your dreams. You have nothing to lose, sink or swim, your call.

Next time: Part 2 - Understanding Exit Paths and Strategic Capacity in Three Charts

We'd love to know what you think: subscribe and please comment, like and share or email blog@growth-drive.com.

Private capital markets do not buy history.They buy confidence. The 85+ Strategic Capacity Asset Class represents businesses that operate at...

Always reading. This week I’ve been thinking about Musk’s musings about Ai exploding productivity. We are already seeing it - our CLAIRE Ai™ can...

Tim Cook had a rule at Apple: Three sentences. Every meeting. “Before any discussion begins, the meeting opener must state three specific points to...