The Three CFO Roles That Separate Lifestyle Businesses from 85+ Assets

Private capital markets do not buy history.They buy confidence. The 85+ Strategic Capacity Asset Class represents businesses that operate at...

Open letter to wealth advisories with over $500MM of AUM, with clients whose businesses generate $3MM-$50MM in annual revenue.

How will you expand your reach and relevance with business-owning clients?

Imagine if in just minutes you could generate a precise analysis of the value and M&A preparedness of every private business in your client base. What could you accomplish with this data?

This data is valuable. It creates three opportunities:

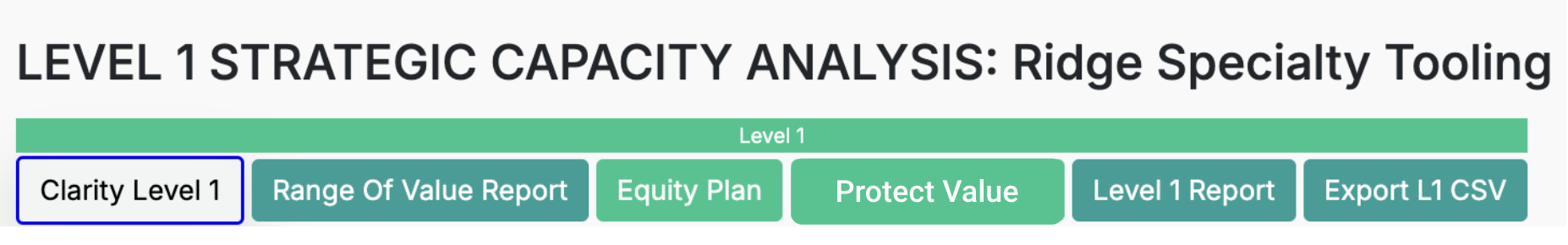

Nav menu in Growth-Drive's CLARITY Strategic Capacity & Business Value Analysis™. Equity Planner and Protect Value are helping successful exit-planning Wealth Advisors uncover immediate product and service sales opportunities while promoting the advisor's relevance to eventual liquidity events (M&A and similar).

The three opportunities have one thing in common: they are immediate revenue opportunities that also protect your client’s current income and future wealth. To this add cementing your relevance to their long-term plans for the business…

Note: if you are a senior leader in the wealth planning space imagine having this data for every business-owning client. Imagine arming your FAs with a simple tool to mine this data. Imagine the services you can discover, the relevance you will create, and the loyalty you will win. Imagine being able to instantly triage these opportunities by size, value, M&A preparedness, product sales opportunity and more. We're looking at you, RIAs and Broker-Dealers.

Three winning opportunities

Three winning opportunities

So here's the thing...

Transferable business value is the ultimate measure of success. Yet most business owners and CEOs lack clarity about the current value of their business and the critical factors affecting their ability to successfully monetize it. You know the dismal stats about your clients having a firm understanding of value and how to monetize... This gap in understanding can limit their ability to convert the equity they’ve built into financial freedom. Who better than you to start this critical conversation?

For Wealth Advisors aiming to expand their reach and relevance with business-owning clients, educating them today about their business's transferable value and its readiness for a successful M&A transaction is crucial. If you don’t, count on the fact that someone else will.

Tools like Growth-Drive’s CLARITY Strategic Capacity & Business Value Analysis™ software easily help you to lead these conversations. This precision tool benchmarks a business’s Strategic Capacity™ —a metric of how the private capital markets will view the business during M&A. By using the private capital market perspective the software helps CEOs see their business through the eyes of Private Equity and M&A pros. Ask yourself: This is the biggest transaction of your client’s life... who better than you to educate them about their risks and options?

Businesses with high Strategic Capacity™ rank as best-in-class and are most likely to excel in due diligence, which serves as the litmus test for a company’s ability to predictably and sustainably generate growing free cash flow. Growing free cash flow drives high multiples at the deal table. Would you be interested to learn that most CEOs focus on growing revenues, while a whopping 83% can't deliver sufficient value to fund the wealth plan?

Growth-Drive’s data, supported by a robust dataset of over 5,000 successful private equity transactions ensures that your analysis is both comprehensive and precise—generally aligning within a few percentage points of formal valuations.

Educating clients with this level of precision allows you to provide actionable insights, while discovering advanced wealth planning, sophisticated compensation/succession planning and value protection insurance opportunities. The Growth-Drive analysis discovers these opportunities and more. Your advisory business becomes the starting point enabling business owners to improve their operations, drive profits, and maximize equity value. And if you are looking to collaborate with quality-assured profit and value growth advisors look no further than our community of C3D certified advisors.

Ultimately, shouldn’t you have overwatch on how your clients approach the monetization of their life’s work while solidifying your role as indispensable partners in client wealth creation?

We are here to help and committed to your success. Call anytime. This is important, so here's my mobile: (603) 359-5894. Thanks, -George

Other good news:

Growth-Drive’s Cohort One for deploying 90.io with clients kicks off TODAY. This is the next step in our shared mission of transforming businesses into best-in-class performers. I’m beyond grateful for everything this community is delivering to the market. Let’s keep building, keep growing, and keep winning. back to top

We value your thoughts: comment here and email blog@growth-drive.com. Thanks.

Private capital markets do not buy history.They buy confidence. The 85+ Strategic Capacity Asset Class represents businesses that operate at...

Always reading. This week I’ve been thinking about Musk’s musings about Ai exploding productivity. We are already seeing it - our CLAIRE Ai™ can...

Tim Cook had a rule at Apple: Three sentences. Every meeting. “Before any discussion begins, the meeting opener must state three specific points to...