The Three CFO Roles That Separate Lifestyle Businesses from 85+ Assets

Private capital markets do not buy history.They buy confidence. The 85+ Strategic Capacity Asset Class represents businesses that operate at...

Picking up on last week's article, how does Strategic Capacity and its two constituents Growth Capacity and Value Capacity play out in a client case? Why does analysis inform strategy?

The Ridge Speciality Tooling case used here part of the Growth Drive Launch Course and companion Playbook. Here's Part 1 of a 2-Part article.

Ridge is owned and run by Diane, who is working with veteran growth advisor Steve.

Let’s look at how the analysis of Ridge’s Strategic Capacity increases Steve’s ability to create strategy and drive the client forward. The very act of discussing Ridge’s capacity to deliver growth and value helped Diane decide to get the engagement ball rolling... when it comes to motivation, there is no substitute for the psychological impact of the client hearing themselves say that they do not meet the best-in-class bar in a number of key areas.

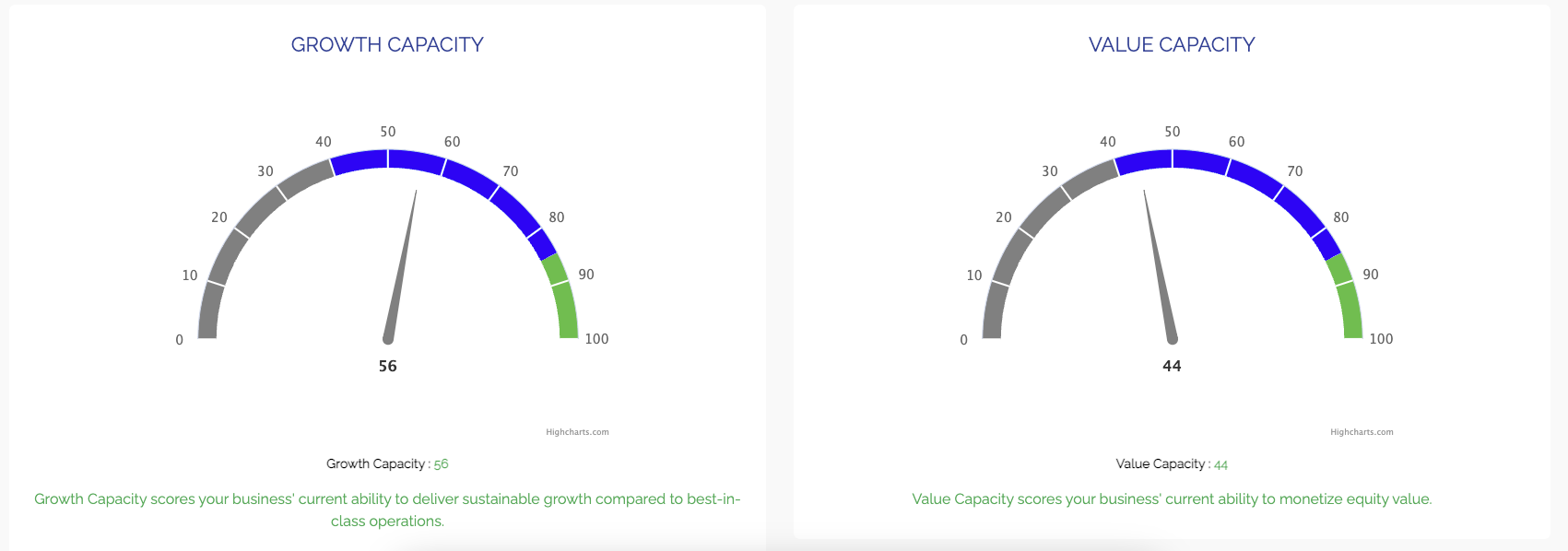

To benchmark against best-in-class you need a score, which Growth-Drive's Clarity Strategic Capacity Analysis does well. If 'high' Strategic Capacity is 100, where does Ridge fall? Clarity gave Ridge a Growth Capacity score of 56% and Value Capacity score of 44%. Taken together these define Ridge's Strategic Capacity. The analysis showed Diane that she needs to execute a redesign of her business if she hopes to reach her personal and professional goals (future lifestyle and dreams). Clarity also identified existing best practices, plus the growth killers and deal killers that need to be cleared before attempting an M&A or other transaction.

from: Clarity Strategic Capacity Analysis ©2023 Growth Drive LLC

Clarity is designed for any advisor looking to understand, communicate and/or take action on growing profits and transferable equity value with middle market business owners and CEOs.

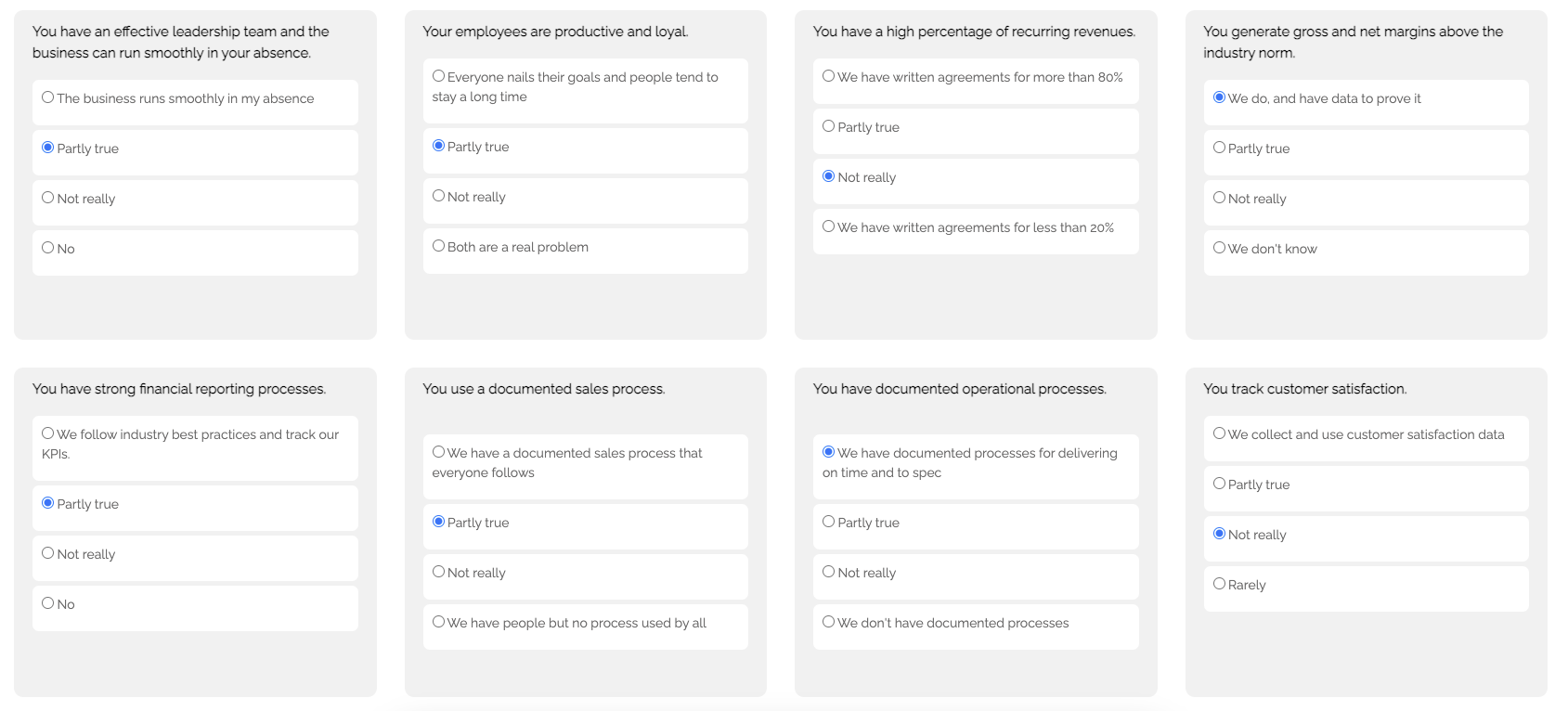

Clarity measures Growth Capacity and Value Capacity using 24 OKRs, 8 in each of the 3 Dimensions of Business Growth. Clarity, which can act as your script for initial client interviews, measures all 24 and generates several scores.

Let's focus on the first of these 24 OKRs, 'Effective Senior Leadership', to show you why analysis informs strategy and helps win engagements. Before we dive into this Growth-Driving Objective let’s take a side trip and recap a few business fundamentals:

Businesses exist to deliver a return to the shareholders; this is as true for private companies as it is for the publics

The fundamental role of the CEO is to maximize shareholder value within the guidelines of the mission and vision

The CEO is therefore accountable to the shareholders

The CEO’s job is to delegate authority, with accountability to the shareholders’ goals, through the senior leadership team up into the entire organization

We can all agree that this gets fuzzy for a typical middle market CEO like Diane. She is the only shareholder, has no board, has lost track of her duty to the shareholders in the day-to-day of operating the business, and has built Ridge's systems and culture on the cornerstone of her control. The Ridge case is representative of middle market businesses who as a group have limited Strategic Capacity.

Hopefully you are now getting a sense of why an ‘Effective Senior Leadership Team’ is the first Growth-Driving Objective in Dimension 1 of the 3 Dimensions of Business Growth. Here's a shot of the survey, focusing here on Dimension 1:

from: Clarity Strategic Capacity Analysis ©2023 Growth Drive LLC

Measuring Ridge against high capacity best-in-class operations and breaking the analysis down into prioritized buckets creates clarity (hence the name) about what Diane and Steve need to do to get the success Diane wants.

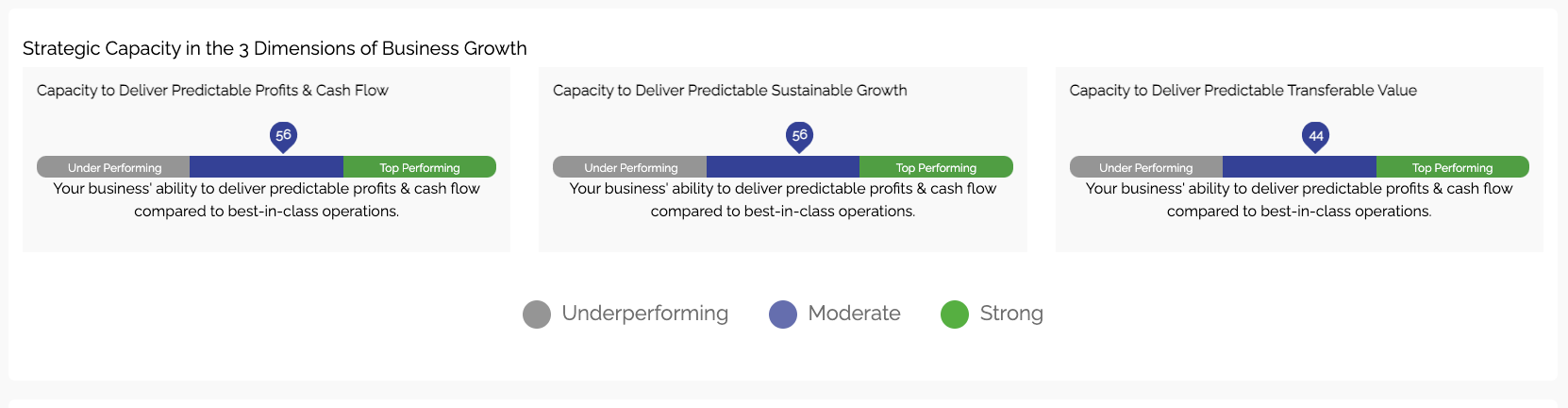

Ridge's Scores:

from: Clarity Strategic Capacity Analysis ©2023 Growth Drive LLC. Recap: Stabilize cash and make the business easier to run is Dim 1. Profitable growth is Dimension 2. Successfully transferring value is Dimension 3. These are the key services you'll learn about delivering through the Growth Drive courses.

Here's the ‘Effective Leadership Team’ OKR in detail:

Objective: Your business has an effective leadership team that is aligned with and accountable to the business' vision and mission, helping the shareholders achieve their objectives.

Key Results which guide bringing the business in line with this Growth-Driving Objective, with underlined emphasis:

The shareholders have written time-bound goals for the business which are shared with the senior leadership team.

Diane’s answer: “Partly True”

The senior leadership team understands and is aligned with the shareholder goals.

Diane’s answer: “No”

Senior leadership is accountable to the shareholder goals.

Diane’s answer: “Not really.” - logical, since she has not shared the goal with her team.

Senior leadership meets regularly to review and discuss progress towards the shareholder goals.

Diane’s answer: “No.”

The business runs smoothly in the CEO's absence.

Diane’s answer: “Partly true.” Like many middle market business owners and CEOs, Diane maintained tight control on information and decision making, and the real answer was “Not really.”

The business has a succession plan for each senior leader.

Diane’s answer: “Not Really.”

By the way, “The business runs smoothly in the CEO’s absence” is present in some form on every due diligence checklist. Bet on it coming up in the first meeting with a prospective acquirer - your role as the growth advisor before this question is asked is to make sure the answer will be a resounding “Yes.”

Clarity's Strategic Capacity Analysis plays out in this chart. Imagine the power of using it with your clients and prospects. Ridge is a Growth Capacity 56, Value Capacity 44: how does this play out?

from: Clarity Strategic Capacity Analysis ©2023 Growth Drive LLC.

from: Clarity Strategic Capacity Analysis ©2023 Growth Drive LLC.

Next week in part 2 of this 2-part series we'll game out the impact that this analysis had on Steve's ability to help Diane and Ridge. Stay tuned.

This article is an excerpt from Growth-Drive Founder George Sandmann's upcoming book, written for business advisors about delivering client wins in the 3 Dimensions of Business Growth, available soon from Advantage|FORBES. Joining the publication list is easy: just click here.

We'd love to know what you think: please comment here, or email blog@growth-drive.com.

Private capital markets do not buy history.They buy confidence. The 85+ Strategic Capacity Asset Class represents businesses that operate at...

Always reading. This week I’ve been thinking about Musk’s musings about Ai exploding productivity. We are already seeing it - our CLAIRE Ai™ can...

Tim Cook had a rule at Apple: Three sentences. Every meeting. “Before any discussion begins, the meeting opener must state three specific points to...