The Three CFO Roles That Separate Lifestyle Businesses from 85+ Assets

Private capital markets do not buy history.They buy confidence. The 85+ Strategic Capacity Asset Class represents businesses that operate at...

3 min read

George Sandmann, Founder

:

Feb 14, 2023 12:32:15 PM

Dear CEO: how well do you know your business? You should think about your world from three perspectives: what you think, what you know, and what you can prove. Data provides hard proof about reality... and while most CEOs need this data they don't know how to get it.

Growth Specialist Scott Barth shared the think/know/prove wisdom in this morning's community Coffee Klatsch (link below). He's right: deep analysis creates total clarity about your business’ strategic capacity to deliver sustainable growth and maximized transferable value. We call this Strategic Capacity.

Businesses with high Strategic Capacity are most likely to outperform their peers. To make capacity actionable, deep analysis should create a Strategic Capacity score; this score predicts how well your business can currently drive sustainably growing cash flow and equity value. These are the twin measures of business success. Strategic Capacity considers performance in all 3 Dimensions of Business Growth: predictable profits, growth and transferable value. Imagine being able to predict all three of these. Best-in-class businesses do.

However, as a concept Strategic Capacity is not focused enough for the purpose of delivering your personal and professional goals. To sharpen focus, Strategic Capacity should properly be divided into its two constituent aspects: Growth Capacity and Value Capacity. A business with high growth capacity and high value capacity has high strategic capacity.

Growth Capacity refers to the business' current ability to deliver sustainable growth compared to best-in-class operations. This focuses on the people, cash and processes needed to generate predictable cash flow and robust sustainable growth.

Value Capacity refers to the business' current ability to monetize equity value. This predicts their ability to successfully complete the normal due diligence required to complete an M&A or similar transaction, considering all three dimensions and weighted for delivering maximized transferable equity value. What this means to you is having high confidence about selling your business for an amount that will support your desired lifestyle.

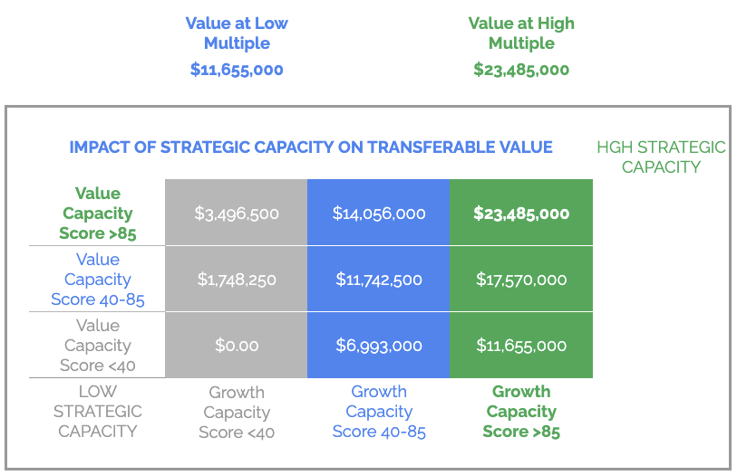

To illustrate this principle, let’s use the following table where Growth Capacity is the X axis, and Value Capacity is the Y axis. Low strategic capacity is in the lower left, and high strategic capacity is upper right. A business with high Strategic Capacity can predictably deliver growth while also presenting a low risk profile to an acquirer and therefore high transferable value.

By measuring Strategic Capacity in the X and Y axes you will learn much about your business, creating clarity and dispelling voodoo. “Voodoo” is what we call that soup of assumptions, chasing shiny objects, bad habits and complacency that you may experience from time to time. Voodoo is normal in privately held businesses, but those select few best-in-class businesses have clarity. You either have clarity or are ruled by voodoo.

If we accept that high equity value is the ultimate measure of business success (why wouldn't the same definition of success apply to privates as it does for publics?), deep analysis of your business will answer two questions: (1) “Why would someone buy this business?” (2) “Why wouldn’t they?”

Here’s how the clarity created by deep analysis plays out. The business in this case is in manufacturing NAICS 31-33 with annual EBITDA of $3.5 Million. The range of multiples (rounded) is 3X-6X EBITDA.

Chart from Growth-Drive's CLARITY Strategic Capacity Analysis™, available to members.

The results reflect the real world: a business in the lower left zone presents as not able to deliver predictable sustainable growth, nor does it have the attributes required for transferring value like a defensible market, audited financials, etc. The result? Fire sale at a fraction of potential value. A business in the upper right zone has robust predictable growth, creates confidence that this growth will continue going into the future, and has its financial and legal houses in order: an upper right business is immortal, going on to greater glory after the current CEO leaves. Same EBITDA but a vast difference in strategic capacity. Ask yourself: which business would you like to own - upper right... or something else?

If you'd like to learn your business' strategic capacity, get with a Growth-Driver today.

This article is an excerpt from Growth-Drive Founder George Sandmann's upcoming book, written for business advisors about delivering client wins in the 3 Dimensions of Business Growth, available soon from Advantage|FORBES. Joining the publication list is easy: just click here.

Growth-Drive is a membership community of senior professionals: Management Consultants, Business Coaches, CPAs, Exit Planners, M&A Advisors and Fractional CFOs.

We are committed to leveraging our community's knowledge, tools & support to leave an indelible positive mark with our clients and with our peers. Does this sound like you? Let's chat: book time with founder George Sandmann here.

Link to the Coffee Klatsch recording, one of many resources on our YouTube channel.

We'd love to know what you think, please comment here or email blog@growth-drive.com.

Private capital markets do not buy history.They buy confidence. The 85+ Strategic Capacity Asset Class represents businesses that operate at...

Always reading. This week I’ve been thinking about Musk’s musings about Ai exploding productivity. We are already seeing it - our CLAIRE Ai™ can...

Tim Cook had a rule at Apple: Three sentences. Every meeting. “Before any discussion begins, the meeting opener must state three specific points to...