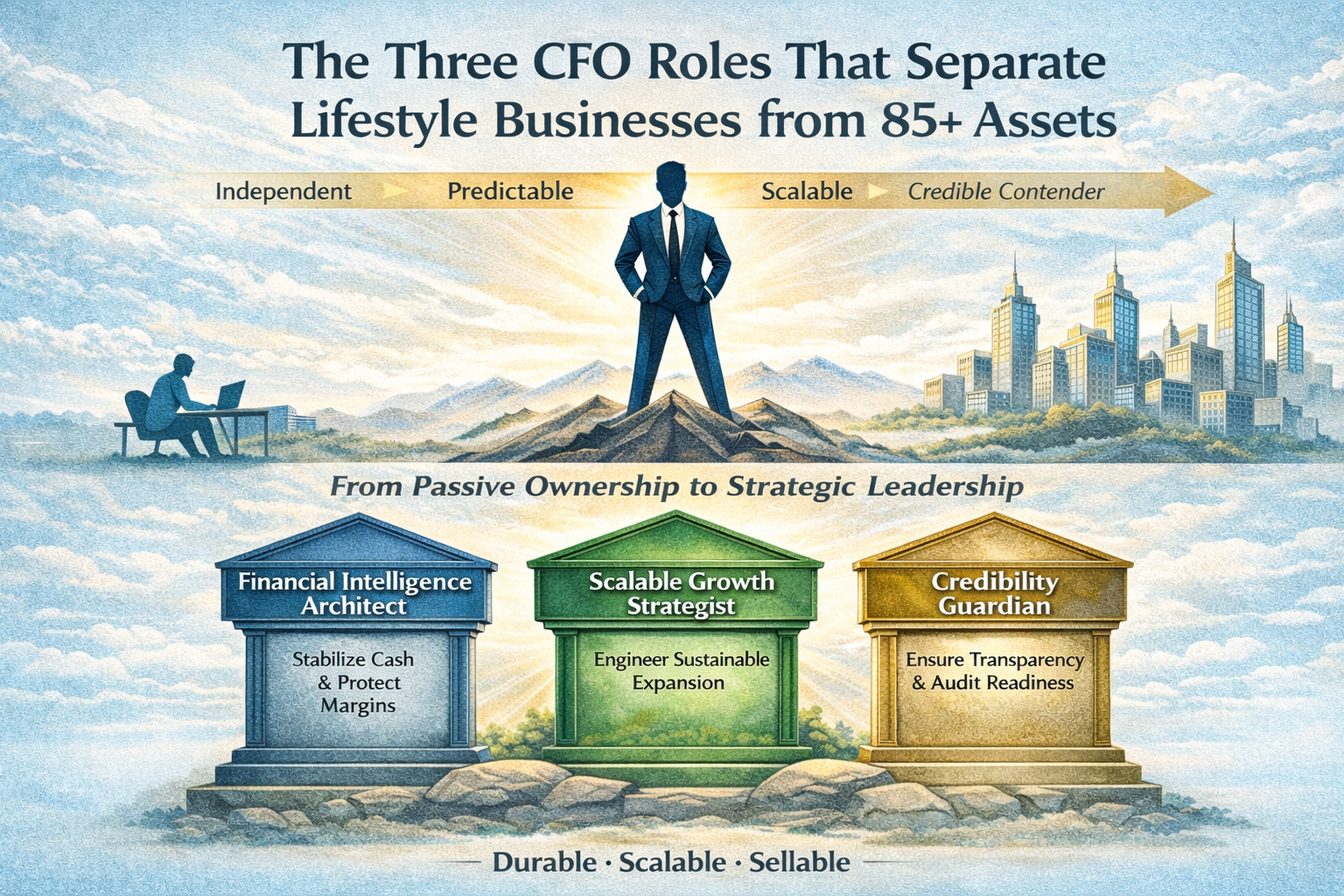

The Three CFO Roles That Separate Lifestyle Businesses from 85+ Assets

Private capital markets do not buy history.They buy confidence. The 85+ Strategic Capacity Asset Class represents businesses that operate at...

Following up on the client-facing article about succession planning, this week you can do the same for strategic planning.

WHAT DOES IT TAKE TO BE 100% CONFIDENT YOUR BUSINESS CAN DELIVER GROWTH?

Why read this article?

You are the owner or CEO of a private business. Do these common complaints sound familiar?

If you’re like most private business CEOs you’re wearing too many hats, working long and unpredictable hours, and everything you try to get off your desk seems to boomerang back.

You are not alone: we make these comments based on feedback from over 50,000 of your peers. This article delivers insights and preliminary advice you can apply in your business immediately. This article explains your business as an engine with defined strategic capacity, making your business immortal, and making sure that you do the things needed to protect your family and stakeholders. Because the data is in: most of your peers don’t.

What do CEOs Want, Anyways?

Based on these ~50,000 responses, we know the following:

62% of CEOs want to grow

21% want operational freedom - they want to make their business easier to run

17% are preparing to sell - only to find out 4 out of 5 times that their business isn’t worth what they need to satisfy their wealth goals

What if you could do all three? Based on this market insight, industry leader George Sandmann created a methodology called “The 3 Dimensions of Business Growth”. Here they are:

Dimension 1: Predictable Profits & Cash Flow - makes the business easier to run while creating the launchpad for growth

Dimension 2: Predictable Sustainable Growth - this is your #1 CEO goal

Dimension 3: Predictable Transferable Value - the ultimate measure of business success with the strategic capacity needed to sell at top value

But let’s ignore these for a sec. Imagine how you would tackle growing your business. How will you grow with the people, cash and processes you have right now? What will you do? Where will you invest? What needs to be in place before making this investment? What bottlenecks should you be prepared to negotiate as growth strains your business engine? Tough questions. This is where gaining total clarity about what your business needs to deliver the success you want matters deeply.

Putting it in Context: Your Market

There are 32.6MM private businesses in the United States, of which 7.8 million have payroll. Of these 560,000 have revenues from $2.5MM-$100MM. This is the Middle Market, in which businesses generate over $10 Trillion in annual revenues, almost 50% of US GDP. If ranked as a world economy the Middle Market would be #3, larger than the GDP of Japan and Germany combined. Private businesses provide 44% of US jobs, and 63% of new jobs. Your business is an important part of our national wellbeing.

The very spirit of independence that drives people like you to start and grow a private business can also become your achilles heel. You are likely a fiercely independent entrepreneur - but have you ever sold a business? Have you ever run a business of the size you dream of? Do you have the people, cash and processes to get there? What if you don’t?

What you might not know is how your strategic capacity - the quality of your growth drivers - helped you get where you are today, and how your strategic capacity may be putting a drag on growing profits and one day selling the business to someone new. Should you know the factors that deliver on these important goals?

This is exactly where understanding your business in the three dimensions of business growth is critical. Let me ask you: how would it feel to understand and improve your business’ strategic capacity so that it’s easier to run, delivering predictable profits and growth, and could sell (if you wanted) at a top price? This would feel pretty good, right? And this begs the BIG question:

What if you had the tools and people to morph your business into a well-run engine producing (1) predictable cash flow, (2) predictable sustainable growth, and (3) maximized transferable value?

This article applies to privately-held businesses at every stage, and is especially relevant to businesses with revenues from $2.5 Million to $100 Million. You may already be in this pool, or you are working hard to get there. As of February 2022 there were only 557,530 businesses in this market. Professionals call this the ‘lower middle market’. I really don’t like that term because it is an outside-in view of the business. If you're the CEO of a $2.5 Million business it feels big - there’s nothing ‘lower’ or ‘middle market’ about it.

Here’s a market breakdown:

|

Gross Revenue Range |

Number of Businesses |

% of Total |

% of Target Market |

|

|

$10,000,000 |

$99,999,999 |

182,690 |

1.17% |

32.77% |

|

$5,000,000 |

$9,999,999 |

149,199 |

0.95% |

26.76% |

|

$2,500,000 |

$4,999,999 |

225,650 |

1.44% |

40.47% |

|

Sub-Total |

557,539 |

3.56% |

||

|

$1,000,000 |

$2,499,999 |

556,639 |

3.55% |

|

|

$500,000 |

$999,999 |

808,940 |

5.16% |

|

|

$0.00 |

$500,000 |

13,752,036 |

87.73% |

|

|

Sub-Total |

15,117,615 |

96.44% |

||

|

Total |

15,675,154 |

|||

Key takeaways: only 4% of businesses break into the lower middle market. Getting to $1MM a year is a big step. Getting from $1MM to $2.5MM is leaping the chasm. And if you’ve made the leap, then be proud: your business is outperforming over 96% of the market and is on the way to creating options for you and your family that aren’t available to your smaller peers. Statistically you have one chance to get your next move right.

Your Next Move: Taking Control

Think of your business as an engine. Within that engine, business processes are the gears and those gears need to be healthy individually and to mesh smoothly with each other. Here’s how the gear analogy plays out. Let’s use marketing as an example. You want to grow, so you hire a marketing guru to deliver leads. Begs these questions: do you have a sales process to convert the leads, or simply a team of folks doing their own thing (and maybe wasting valuable leads)? And once a sale is made, delivering the ROI for all the money you spent on marketing, how strong are your operational processes to deliver the new sales? Are the operational processes strong enough to create high customer sat? Is high customer sat linked back to sales so you can generate recurring revenues? You get the picture. You need a holistic approach to measure your gears, strengthen them and get them spinning in sync. Bottom line: if you want to become a best-in-class business then you need a business that’s humming, a powerful machine fine-tuned to grow.

Launching the Rocket: What are Best-in-Class Businesses Doing?

You want to grow, but you cannot launch a rocket with a slingshot, right? The real question then is “How do we launch the growth rocket?” By creating a launchpad of people, cash and processes. By applying the Three Dimensions of Growth methodology you will design and build the launchpad, design and build the rocket, and light the candle.

Would you accept this premise? Best-in-class businesses are run using best-in-class processes. If we agree, then reaching your growth goal requires you to redesign your business so that it is running using best-in-class processes. You need to improve the quality of your business - you need to create high strategic capacity.

High strategic capacity simply means a business can demonstrate on paper and in results that it has a proven ability to reach its goals. The goals are usually measured in dollars of revenue and/or dollars of equity value. Strategic Capacity has two elements: Growth Capacity and Value Capacity.

You live in a Growth Capacity world. All of the things you need to generate cash, grow, keep your people happy and delight your customers fall under this umbrella. These are the growth-driving objectives in Dimensions 1 and 2. And because you’re making payroll, feeding your family and taking care of your customers, life is good, right? You can sell your company when you want and for the price you need.

Unfortunately no. For most, their business can’t inspire enough confidence from the private capital markets - they simply don't have the strategic capacity. This false sense of security explains why 19 of 20 companies cannot sell, and of those that can, 4 out of 5 can’t sell at a high enough price. Do the math: market data shows that 99% of businesses fail to deliver. Statistically, this is you.

“My business is profitable, and although we have our issues it’s a good business.” Agreed - let’s stipulate this point. But the market demands more. The market not only demands predictable profits and growth, it also demands high Value Capacity. Value Capacity is a measure of M&A preparedness, put pragmatically it’s a measure of whether or not you’ll survive due diligence. Businesses that don’t prepare don’t survive.

Lack of Value Capacity is the reason so many M&A deals fail. Value Capacity measures your ability to create high confidence in a buyer that the business can continue to grow and deliver cash going into the future. Forever. As in immortal. Because if the business is not immortal, if it cannot go on to be bigger and better after you are gone… it either won’t sell at all or will sell at a bargain basement price.

Immortal businesses have high strategic capacity, immortal businesses are strong in all three dimensions of business growth. Immortal businesses are the ones the money chases, that money must have, that deliver financially for their owners and stakeholders.

If this makes sense, please ask yourself: do you want your business to be immortal?

Next steps: here are your options

Have questions? We are happy to help, you can book a free no obligation consultation today - based on that conversation the next step if any is completely up to you.

This article is based on my book: Sandmann, G. (2023), The Growth-Driving Advisor: Proven Strategies for Leading Businesses from Stuck to Best-in-Class. Charleston, SC: Forbes Books.

To each of you: email blog@growth-drive.com to get a copy of this article you can use your marketing collateral (printed or digital).

Free (no card, free forever) CLARITY Strategic Capacity Analysis Lead Generator module.

Thank you, together we are executing towards our vision of helping $1 Trillion of privately held businesses increase strategic capacity in the three dimensions of business growth™. -George

Private capital markets do not buy history.They buy confidence. The 85+ Strategic Capacity Asset Class represents businesses that operate at...

Always reading. This week I’ve been thinking about Musk’s musings about Ai exploding productivity. We are already seeing it - our CLAIRE Ai™ can...

Tim Cook had a rule at Apple: Three sentences. Every meeting. “Before any discussion begins, the meeting opener must state three specific points to...