The Three CFO Roles That Separate Lifestyle Businesses from 85+ Assets

Private capital markets do not buy history.They buy confidence. The 85+ Strategic Capacity Asset Class represents businesses that operate at...

4 min read

George Sandmann, Founder

:

Feb 2, 2023 10:55:56 AM

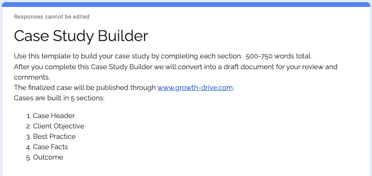

What does it look like when you apply the Growth-Drive principles to deliver client wins? We use case studies to democratize members' skills and techniques. Here's a case about using a sophisticated stock redemption plan to successfully transfer value using a tax-efficient structure.

Growth-Drive is the leading community of senior professionals focusing on growing profits and transferable value. One of our guiding principles is to “create an indelible positive impact with every client,” which Growth Specialist Anna Halaburda clearly does here.

The focus of this case study is Dimension 3 of the 3 Dimensions of Business Growth™.

Dimension 1: Create Predictable Profits & Cash Flow

Dimension 2: Create Predictable Sustainable Growth

--> Dimension 3: Create Predictable Transferable Value

Here is the case in Anna's own words. Headings in italic are from our online case study builder.

Business Advisor Bio:

Growth Specialist™ Anna Halaburda CPA, CFP and CBEC has over forty years of business experience. Anna is the founder of Be Ready Inc., which specializes in business exit planning, profitability and transferable value growth consulting, and transaction support services. Anna combines her growth advisory, accounting, financial planning and exit planning skills to help her clients achieve their pre- and post-exit goals.

Case Background:

Owner's goal: business transfer in a tax efficient structure.

Industry: 54133 - Engineering Services

Gross Annual Income: $4,000,000.00

Net Annual Profits or EBITDA: $1,700,000.00

Number of Employees: 9

Which of the Growth-Driving Objectives are involved? (1 or more e.g. “Effective Senior Leadership", ”Financial Reporting Processes" etc):

Effective Senior Leadership and Scalable Marketing Process, with an eye on growth.

Additional facts --brief narrative, suggested length 100 words:

The owner is transitioning out of the business and wants to provide his five key employees with equal ownership shares in a manner that is tax advantaged to him. He has been comfortable in the amount of revenue that the company spins off to him but with multiple new owners he knows that the company needs to have a solid leadership structure that understands how to efficiently run and grow the business.

Identify the key problems and issues in the case study. Formulate and include a thesis statement, summarizing the outcome of your analysis in 1–2 sentences:

Key employees do not have adequate funds or cash flow needed to purchase the business and the business owner needs fair value for his business in order to phase out and retire.

Traditional equity value monetization (business sale) approaches lose too much to taxes and debt service .

Set the scene: background information, relevant facts, and highlight the most important issues. How did you meet the client? If appropriate, demonstrate that you have researched the problems in this case study:

I was referred to this client by an M&A firm that realized that a stock redemption plan was the most appropriate strategy for an internal ownership transfer.

Outline possible alternatives (not necessarily all of them). Explain why alternatives were rejected. Constraints/reasons: Why are certain alternatives not possible at this time?

Outright sale to Key Employees - in this instance, the key employees did not have the necessary funds for a traditional business sale/purchase even though they made above average income. In addition, any debt financing would absorb excess cash flow. This would delay the benefit of ownership by not having the cash flow to distribute to the new owners for an estimated 10 year amortization period. Plus, they would still need to pay the tax on the pass through income that was being used to service the debt.

Provide one specific and realistic solution. Explain why this solution was chosen. Support this solution with solid evidence:

A structured stock redemption plan allowed the key employee buyers to become owners without the need for a cash down payment and outside financing. In addition, the owner receives the proceeds in a tax efficient manner so that the sales price can be lower and still result in the same net (after tax and fees) dollar amount to the owner.

Feel free to add anecdotes, relevant stories for example that help put the case/solutions in context:

The buyer did not have the resources or credit worthiness to purchase the business. Through this structured stock redemption plan, over several years he will own 100% of an $8,000,000.00 business with no money out of pocket. The buyer calls this “The modern version of The American Dream!”

Determine and discuss specific strategy(ies) for accomplishing the proposed solution. If applicable, recommend further action to resolve some of the issues. What should be done and who should do it? Executive Team? Advisor? Collaborating Advisors (outside talent, subject matter expertise).

The structured stock redemption plan does take about five years to complete and the employee-turned-business-owner needs to be educated on how to run, maintain and grow the business. They need to understand the business profit and value drivers and have someone assist them in applying that new knowledge. This exit strategy often turns into a multiple year engagement and the advisor quickly becomes the most trusted advisor during this period.

In addition to working with the business owner, an advisor must also work with the new owner's other professional advisors who quickly become resources for future business.

How did this project impact the company, using specific metrics such as "Met owner’s stated goals (examples: better work/life balance; closed personal value gap)." Ex: Increased Gross Revenues and/or EBITDA; Increased Operational Performance according to [...] metric; Increased Enterprise Value; Company successful transition, etc.?

This structured stock redemption plan provided the means for business owners to transfer their business to the best suited next owner and not the one who could afford it. It also passes the monetization of the business asset to the owner in the most tax efficient manner so if the owner "sells" the business for $10M, he nets $10M.

This Growth-Drive Case Study was prepared by Growth Specialist Anna Halaburda, CPA, CFP, CBEC. Be Ready Inc., 720-520-1543 - anna@bereadyexits.com - https://www.bereadyexits.com.

Interested in exploring membership? Book your initial consultation, it's easy and only takes about 20 minutes.

Editor's note: Anna owns a lifetime membership in the Growth-Drive community. She is a skilled and experienced practitioner committed to the power of collaboration. Anna heads a Leader-level Business Advisor Peer Group, coaching pros dedicated to equity growth and monetization. This group is just one of several; we are interviewing prospective members now. Contact to learn more, please use subject "Peer Group".

Private capital markets do not buy history.They buy confidence. The 85+ Strategic Capacity Asset Class represents businesses that operate at...

Always reading. This week I’ve been thinking about Musk’s musings about Ai exploding productivity. We are already seeing it - our CLAIRE Ai™ can...

Tim Cook had a rule at Apple: Three sentences. Every meeting. “Before any discussion begins, the meeting opener must state three specific points to...