The Three CFO Roles That Separate Lifestyle Businesses from 85+ Assets

Private capital markets do not buy history.They buy confidence. The 85+ Strategic Capacity Asset Class represents businesses that operate at...

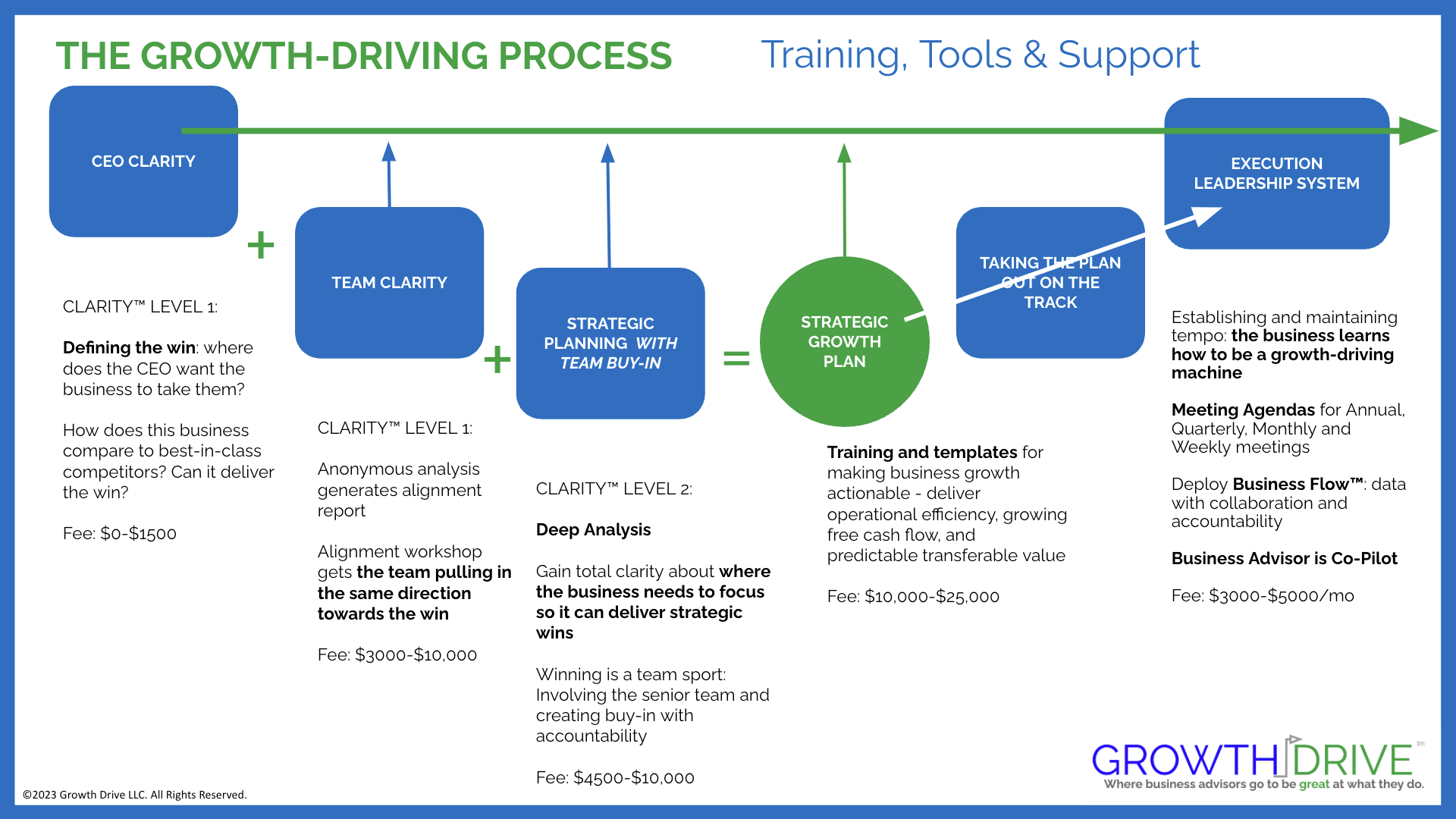

Growth-driving advisors like you can really dig in when you deploy a proven process. Proven to do what? Proven at making business profit and value growth ACTIONABLE.

I'm just back from a terrific conference chock-full of senior professionals who have one thing in common: everyone there focuses like a laser beam on helping their clients achieve personal and professional success. For the typical CEO these two are closely linked, right? And you should be their co-pilot.

(c)cameracourage.com

This gave me three days to chat with some really smart cats about all sorts of topics, and the bottom line is this: no matter where you want to play, business advisors are the CEO's co-pilot on a journey to winning. What does winning look like? More often than not, winning means more free cash flow, business growth and personal wealth. And the best kind of winning delivers these for the CEO, sure - but importantly also for their stakeholders and the professionals who serve them. If you deliver these wins you will also be building a thriving advisory business (and probably won't ever have to go looking for new clients again).

How do you get there? Check out the attached three charts describing the Growth-Drive Process. I tend to add a lot of detail, and hope you'll forgive. You can summarize it this way:

Here's what it might look like (you can download these graphics here):

You may already know that Growth-Drive is all about meeting people where they are... Find out what your client really wants and start by helping them with that. For example there's no sense insisting the CEO focus on transferable value if all they want is better work-life balance, right? Meet them where they are and then as you build trust you can educate them about additional options (aka wins).

We believe the same thing about Business Advisors. If you've been through our training you know about "1-5" (thank you @FrancisBrown). A 1 or 2 is usually an Exit Planning Wealth Advisor who wants to start conversations and maintain relevance over the long term. A 4 or 5 is a hard-core business advisor who wants to design strategy and be the co-pilot during strategic execution. Wherever you are you want the training, tools and support to be sharp and confident. Right?

OK, so this begs the question. What does this proven process look like from the business advisor's perspective? How do you build a thriving advisory business in line with your own goals? Wherever you are 1-5, you should have the tools and confidence to get the process rolling and a smooth way to collaborate with the pros who do what you don't. Building a business is a team sport, right? Here's the advisor's view, with tools and fees highlighted:

You might be thinking "Wow, that looks complicated...." Don't worry, it's not - it's straight forward if you have a little training. Training should answer your "Now whats?". Hey, my client wants to grow profits. Now what? My client wants me to help write a strategic plan - now what? My client wants help turning the plan into reality - now what? Cool, here's what that looks like from a training perspective:

Aaaaaand, both client engagements and business advisor resources should be a tailored fit, rather than one-size-fits-most. The two are symbiotic, right? We think so.

OK that was fun. What is your process? Where do you fit in? Are you a 1 or a 5? We'd love to know what you think, please comment below or email blog@growth-drive.com.

PS: that conference was the excellent Business Exit Institute annual do. BEI is about so much more than mere "exit". Maybe check them out.

Private capital markets do not buy history.They buy confidence. The 85+ Strategic Capacity Asset Class represents businesses that operate at...

Always reading. This week I’ve been thinking about Musk’s musings about Ai exploding productivity. We are already seeing it - our CLAIRE Ai™ can...

Tim Cook had a rule at Apple: Three sentences. Every meeting. “Before any discussion begins, the meeting opener must state three specific points to...